Ever heard the saying, “Don’t Put All Your Eggs in One Basket”?

Well, legend has it that a crypto master coined it. And looking at the risk in crypto trading, we can say he was right.

Let’s face it, the crypto world is a rollercoaster. Prices can skyrocket one day and plummet the next. But there’s a way to smooth out the ride: enter diversification.

What is diversification?

Imagine if you only invested in Bitcoin and it took a nosedive. Ouch!, right? But if you had some Ethereum and a few other coins, the loss wouldn’t hit you as hard. Diversification is like having a safety net.

Simply put, it means spreading your investments across various assets to reduce risk. In a crypto context, it means investing in a mix of different cryptocurrencies rather than putting all your eggs in one basket. Think of it like building a sturdy house: a strong foundation requires several materials, not just one.

Why is diversification important?

The cryptocurrency market is notorious for its volatility. Prices can fluctuate wildly in a short period, driven by factors like market sentiment, regulatory changes, and technological advancements. By diversifying your portfolio, you can help cushion the effects of these fluctuations. If one cryptocurrency experiences a downturn, the others might perform well, cushioning your overall investment.

Steps to balance risk in crypto trading

- Assess your risk tolerance. Before you start investing, it’s essential to understand your risk tolerance. Are you comfortable taking on higher risks for potentially higher returns, or do you prefer a more conservative approach? Your risk tolerance will guide your asset allocation.

- Choose a mix of currencies: Don’t limit yourself to a few well-known coins. Explore the broader crypto landscape and consider investing in a variety of assets, including:

- Established Coins: Bitcoin and Ethereum are the most well-known and often considered less risky due to their market capitalization and established infrastructure.

- Altcoins: These are alternative cryptocurrencies that offer unique features or solve specific problems. Some popular altcoins include Solana, Cardano, and Polkadot.

- Stablecoins: These are cryptocurrencies pegged to a stable asset, like the US dollar. They can provide a more stable store of value and help to reduce volatility in your portfolio.

- Established Coins: Bitcoin and Ethereum are the most well-known and often considered less risky due to their market capitalization and established infrastructure.

- Consider Different Sectors: The crypto market is vast and diverse, with various sectors like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and gaming. Spreading your investments across different sectors can help to reduce your exposure to specific risks.

- Rebalance Regularly: As the value of different cryptocurrencies fluctuates, it’s important to rebalance your portfolio periodically to maintain your desired asset allocation. This ensures that you don’t become overly concentrated on any particular asset.

Beyond Cryptocurrencies

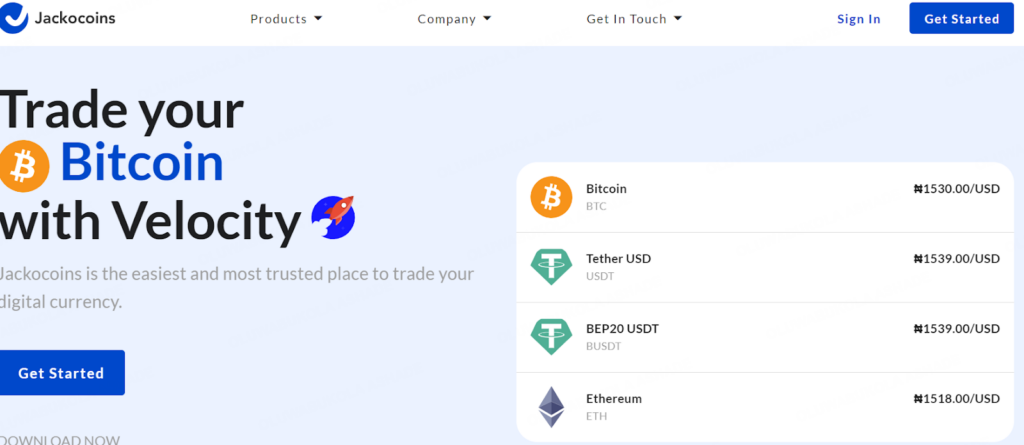

While diversifying within the crypto market is crucial, you can further enhance your risk management by including traditional assets in your portfolio. Consider adding stocks, bonds, or real estate to balance out the volatility of cryptocurrencies. Jackocoins helps you realize your financial goals by providing high fiat conversion rates for your top coins with no withdrawal or deposit cost.

The Bottom Line

Diversification is a powerful tool for navigating the unpredictable world of cryptocurrencies. Basically, don’t bet all your chips on just one coin. Spread your money around various cryptocurrencies, like Bitcoin, Ethereum, and maybe even some up-and-coming ones.

Remember, there’s no one-size-fits-all approach. The best strategy for you will depend on your individual risk tolerance and investment goal.

Visits: 30

Thanks I have recently been looking for info about this subject for a while and yours is the greatest I have discovered so far However what in regards to the bottom line Are you certain in regards to the supply