In the rapidly evolving world of digital finance, tokenization, and asset backing are transforming how we perceive and interact with assets. From real estate to art, the ability to represent physical and intangible assets digitally opens new avenues for investment and ownership. This article explains the concepts of tokenization and asset backing and explores how Jackocoins is at the forefront of this revolution.

Understanding Tokenization

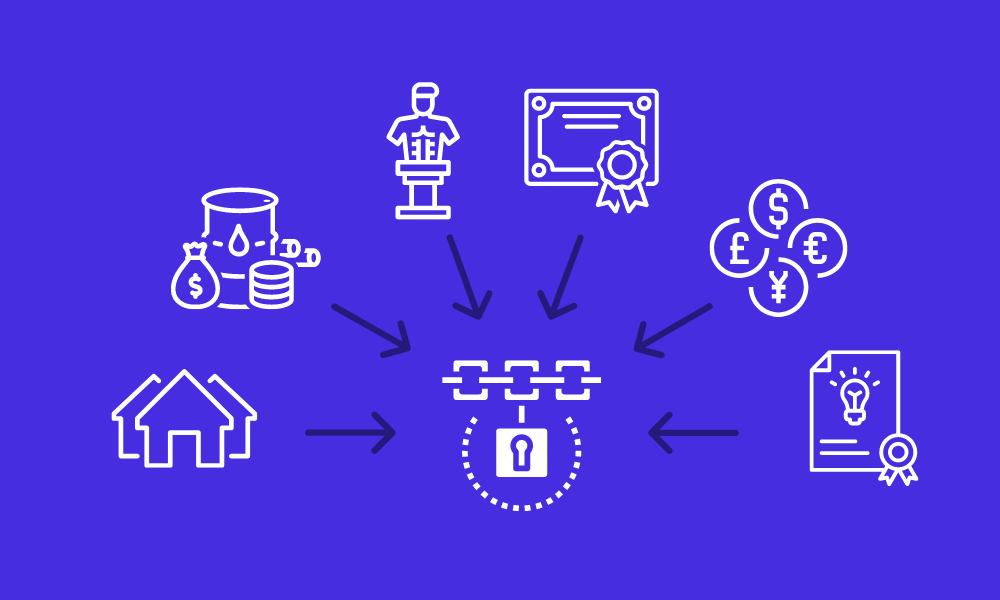

Tokenization is converting real-world assets into digital tokens that live on a blockchain. Imagine owning a fraction of a high-value asset like real estate or art. Instead of dealing with the complexities of traditional ownership, you can buy and trade these digital tokens, making investment more accessible and streamlined.

The process begins with identifying and valuing the asset you want to tokenize. Then, a digital representation of the asset is created in the form of tokens on a blockchain. These tokens can be bought, sold, or traded just like any other cryptocurrency, but they represent a share of a tangible or intangible asset.

Tokenization not only democratizes access to investments but also enhances liquidity and transparency. By breaking down large assets into smaller, tradable units, more people can participate in the investment, and the blockchain ensures that every transaction is secure and transparent. This modern approach to asset management is reshaping how we think about ownership and investment.

How does tokenization work?

Tokenization works through asset identification, digital representation, and ownership distribution. Let’s look at each of them in detail.

- Asset Identification

The first step in tokenization is identifying and valuing the asset you want to tokenize. This could be anything from real estate and artwork to commodities like gold. Once you select the asset, you assess its value to ensure it is digitally accurate. This process sets the foundation for creating digital tokens that will represent ownership shares of the asset, making it easier for people to invest in and trade parts of valuable items without the complexities of traditional ownership.

- Digital Representation

After you identify and value the asset, the next step is to create its digital counterpart. This involves generating digital tokens on a blockchain that represent ownership shares of the asset. These tokens are designed to be easily transferable and tradable, providing a seamless way for investors to buy and sell fractions of the asset. By leveraging blockchain technology, these digital tokens ensure transparency, security, and immutability, making the investment process both efficient and trustworthy.

- Ownership Distribution

After creating digital tokens, the final step is distributing these tokens to investors. Each token represents a share of the asset, allowing investors to buy, sell, and trade these shares easily. This distribution can take place through various platforms, making it simple for investors to participate in the market. By breaking down the asset into smaller, tradable units, tokenization democratizes access to investments, enabling more people to own a piece of valuable assets without the need for substantial capital.

Asset Backing

Asset backing is all about ensuring that digital tokens have real-world value by linking them to tangible or intangible assets. Think of it as a way to give digital tokens stability and credibility. For example, a digital token could be backed by physical assets like real estate or gold, meaning each token represents a specific portion of that asset. This linkage not only provides investors with confidence that their digital holdings are secure in actual value but also helps mitigate the volatility often seen in purely speculative digital currencies.

Different types of asset backing serve various purposes and appeal to different investor needs. Fiat-backed tokens receive support from traditional currencies like USD or EUR, providing a familiar and stable value base. Commodity-backed tokens can link to precious metals or other physical goods, adding a tangible asset layer to the investment. Real estate-backed tokens, on the other hand, tie their value to property holdings, offering a way to invest in real estate without the usual complexities. This variety in asset backing options allows investors to choose tokens that align with their investment strategies and risk tolerance.

Types of Asset Backing

- Fiat-backed tokens

Fiat-backed tokens are digital tokens that derive their value from traditional currencies like USD or EUR. These tokens receive tangibility from reserves of the corresponding fiat currency, providing a stable and familiar value base for investors. This type of backing ensures that each token can trade for a set amount of fiat currency, offering a reliable and less volatile investment option compared to many other cryptocurrencies. This stability makes fiat-backed tokens an attractive choice for those looking to enter the digital asset space with reduced risk.

- Commodity-backed tokens

Commodity-backed tokens are digital assets that get their value from physical commodities like gold, oil, or other tangible goods. Each token represents a specific quantity of the commodity, which holds its reserve back to the token’s value. This type of backing provides investors with a sense of security, knowing that their digital tokens link to real-world, valuable assets. It’s a way to bring the tangible value of commodities into the digital realm, making it easier to trade and invest in these assets without the physical logistics.

- Real estate-backed tokens

Real estate-backed tokens are digital representations of property investments, allowing you to own and trade fractions of real estate. Each token corresponds to a share of a property or a portfolio of properties, providing a way to invest in real estate without the traditional barriers and complexities. This method democratizes access to the real estate market, enabling investors to diversify their portfolios and benefit from property appreciation and rental income without the need for large capital or direct management responsibilities.

Benefits of Tokenization and Asset Backing

- Increased Liquidity: Tokenization allows assets that were previously illiquid, like real estate, to be traded easily, enhancing market liquidity.

- Improved Transparency and Security: Blockchain technology ensures that all transactions are transparent and secure, reducing the risk of fraud.

- Fractional Ownership: Investors can own a fraction of an asset, lowering the barrier to entry for high-value investments.

- Reduced Transaction Costs: Traditional asset transactions involve intermediaries, which can be costly. Tokenization minimizes these costs by leveraging blockchain technology.

Jackocoins’ Role in the Digital Asset Space

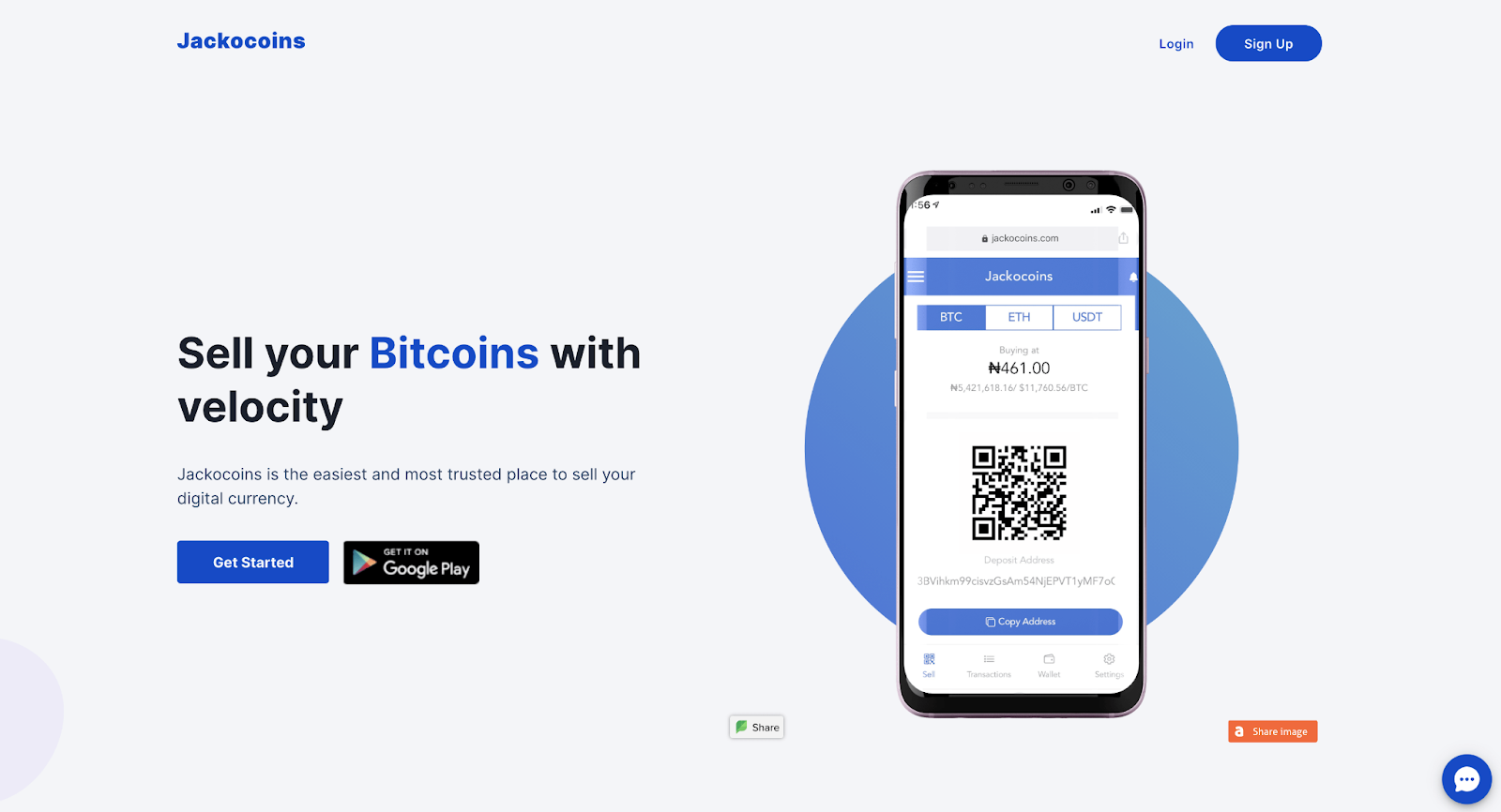

Jackocoins, a leading cryptocurrency exchange in Nigeria, is playing a crucial role in facilitating tokenization and asset backing. Their platform offers several unique features:

- High Rates and Fast Payments: Leveraging extensive trading experience and strong liquidity partners, Jackocoins provides competitive rates and quick transactions.

- Robust Wallet Security: With cold storage options, Jackocoins ensures the security of digital assets.

- Flexible Trading Options: Users can switch between automated and manual trading, catering to both novice and experienced investors.

- Zero-fee Transfers: Internal transfers between users are free, enhancing the platform’s usability and attractiveness.

Technical Insights

Jackocoins employs advanced blockchain technology to support tokenization and asset backing. Their platform’s security measures, such as cold storage, ensure that assets are protected from cyber threats. Additionally, the option to choose between automated and manual trading allows users to tailor their trading experience to their expertise level.

The Parting Shot

Tokenization and asset backing are revolutionizing the digital asset space, making investments more accessible, transparent, and secure. Jackocoins stands out in this field, offering a reliable and innovative platform for trading and securing digital assets. To experience these benefits firsthand, get started with Jackocoins today and take advantage of their cutting-edge services.

Visits: 9750

Your article helped me a lot, is there any more related content? Thanks!