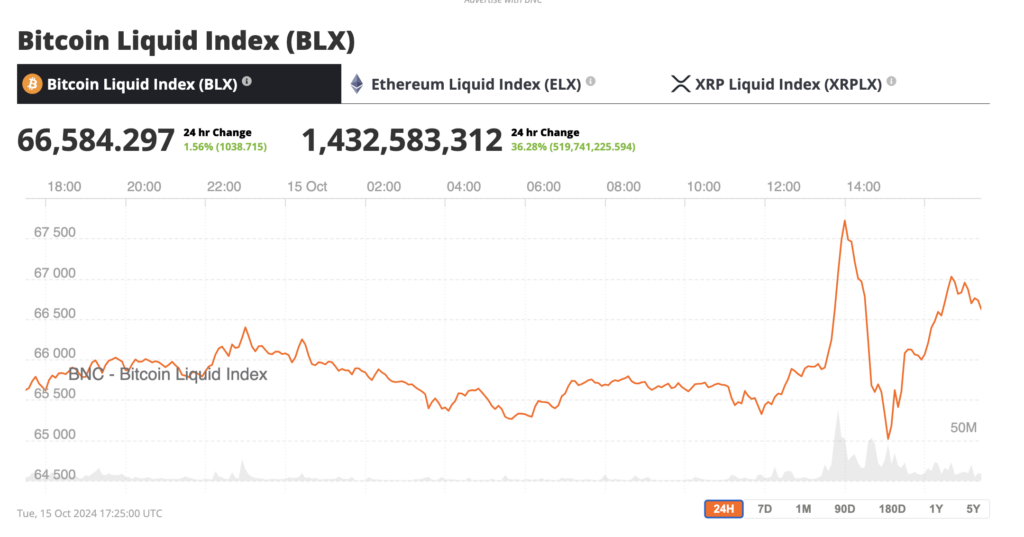

Cryptocurrency enthusiasts and investors are riding a wave of optimism as Bitcoin to surge upward, reaching close to $68,000. This surge represents a 9.5% increase over the past week and a 2.8% rise in just a single day. What’s fueling this excitement? It’s not just the usual market volatility; the spotlight is on a major development—massive inflows into U.S. spot Bitcoin ETFs. These investment products attracted over half a billion dollars in just one day.

Bitcoin ETFs: The New Investment Magnet

Bitcoin exchange-traded Funds (ETFs) act as a bridge between traditional finance and the crypto industry. Unlike directly buying Bitcoin, investors can buy shares in ETFs that track Bitcoin’s price, making it easier and more accessible for those in mainstream finance to participate in the crypto market.

And the results are speaking for themselves—on October 14th, Bitcoin ETFs recorded net inflows of a staggering $555.9 million, according to Farside, a Bitcoin ETF tracker. This marks the highest inflow since June and clearly signals that institutional interest in Bitcoin is at an all-time high.

But why the sudden Bitcoin surge?

The launch of new spot Bitcoin ETFs has rekindled investor interest. Leading the pack is Fidelity’s Wise Bitcoin Origin Fund (FBTC), which saw inflows of $239.3 million, its highest since the summer. Bitwise Bitcoin ETF (BITB) followed with just over $100 million, while BlackRock’s (BLK) iShares Bitcoin Trust (IBIT) attracted $79.5 million. Even Grayscale’s Bitcoin Trust (GBTC), which experienced outflows, reversed course with $37.8 million in inflows.

This renewed faith in Bitcoin ETFs is being compared to the rise of gold ETFs, which, for years, have been seen as a hedge against inflation and economic uncertainty. Bloomberg senior ETF analyst Eric Balchunas drew comparisons, noting that while Bitcoin ETFs have brought in $19 billion in net flows, gold has seen $1.4 billion in the same timeframe. It seems that Bitcoin is solidifying its status as “digital gold,” a store of value that is increasingly accepted as a mainstream asset.

Bitcoin’s Ripple Effect Across the Crypto Market

Bitcoin’s bullish run has extended beyond just its own price rise. Other cryptocurrencies are also enjoying the ride, with some seeing even more significant gains. Ether (ETH), the second-largest cryptocurrency by market capitalization, climbed over 8% in the past week, now trading at $2,600. Altcoins like Solana, Dogecoin, and Cardano also saw impressive weekly gains, with Solana up 10%, Dogecoin rising 15%, and Cardano increasing by 5%.

This broader crypto market rally suggests that Bitcoin’s rise is reigniting investor confidence across the entire digital asset space. It also points to an important trend—when Bitcoin thrives, it often acts as a rising tide lifting all other cryptocurrencies.

What’s Next for Bitcoin?

As Bitcoin continues its upward trajectory, the big question on everyone’s mind is: where is the top? With strong inflows into Bitcoin ETFs and growing interest from institutional investors, there’s reason to believe that Bitcoin could test new all-time highs in the coming months. Historical trends suggest that Bitcoin has more room to run, especially as traditional finance becomes more comfortable with cryptocurrency exposure through regulated products like ETFs.

Moreover, the increasing acceptance of Bitcoin by major financial institutions, such as BlackRock and Fidelity, signals a fundamental shift in Bitcoin perception. No longer just a speculative asset, Bitcoin is becoming a trusted part of a diversified portfolio for many investors. This shift could pave the way for further adoption, driving prices higher.

A Bull Run With Staying Power?

This bitcoin surge, fueled by massive inflows into ETFs and growing institutional support, signals a turning point in the cryptocurrency market. It’s not just retail investors driving the price up—this time, it’s the big players in finance. With Bitcoin’s rise, other cryptocurrencies are following suit, and the momentum shows no signs of slowing down.

For investors, the key question now is not whether to get involved, but how to position themselves for what could be another historic run. Whether you’re an investor or just watching from the sidelines, Bitcoin’s bullish wave is one worth watching.

Enjoy fast repayment and the latest BTC, USDT, ETH and more on jackocoins. Sign up and start trading now

Visits: 37