What would you do if you had one million dollars?

In a place where inflation can make managing money difficult, sustaining financial stability looks unrealistic. That is until USDT entered the scene.

Unlike traditional banking systems that can seldom keep up with economic fluctuations, this digital currency allows you to store your wealth without being tied to the unpredictable swings of the local economy. All these are possible by choosing the best USDT trading platform in Africa.

Does that sound like a game plan for your financial security? Keep reading to discover how to save your assets despite the rising economic inflation.

Current Inflation Trends in Africa

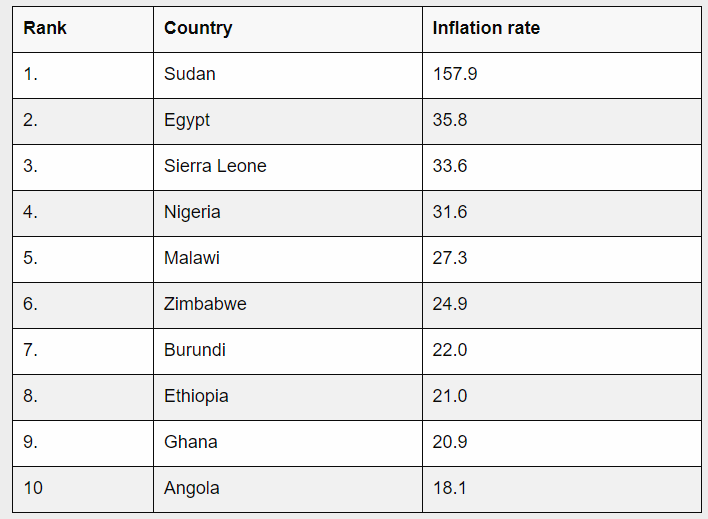

Inflation rates across Africa, including Nigeria, have remained high, impacting economic stability significantly. Sudan currently faces the highest inflation rate in Africa at 157.9%, followed by Egypt at 35.8%, and Sierra Leone at 33.6%. Nigeria is also grappling with inflation at 31.6%, while Malawi and Zimbabwe experience rates of 27.3% and 24.9%, respectively. Other countries like Burundi (22.0%), Ethiopia (21.0%), Ghana (20.9%), and Angola (18.1%) are also dealing with significant inflation challenges.

While these numbers sink in, ask yourself; Will people in these countries have enough assets to save with the high inflation?

The rising prices for goods and services always erode the value of their local currencies, making it challenging for individuals and businesses to maintain financial security in Africa. As inflation persists, traditional savings methods struggle to keep up with the devaluation of local currencies, creating a pressing need for alternative financial tools.

How Inflation Affects Savings and Trading

Inflation directly impacts savings by reducing the real value of money. For example, high inflation means that the purchasing power of saved money diminishes over time, making it harder for people to achieve their financial goals. For traders and investors, this economic instability introduces considerable risk, as inflation can erode investment returns.

USDT (Tether) has a promising solution in this context. As a stablecoin, USDT helps mitigate the effects of inflation and currency devaluation. By using Tether for trading or holding assets, investors can preserve the value of their capital and reduce the risk associated with local currency fluctuations.

As digital Africa expands, USDT provides a stable medium of exchange and a secure store of value. Traders can use Tether to navigate uncertain economic situations with greater confidence.

How can USDT Help You Streamline Your Transactions?

If you’re involved in cross-border trading or managing international clients, Tether can greatly simplify your transactions. Traditional methods have high fees and delays, complicating the process and increasing costs. USDT offers a cost-effective and efficient alternative, allowing you to transfer funds quickly and smoothly across borders. This efficiency helps you manage your trading operations more effectively and strengthens your international business relationships by removing transaction barriers.

Improve Investment Options

When it comes to investing in various cryptocurrencies or other assets, USDT provides a stable place to keep your funds. Local currencies are often unstable, with their value changing rapidly. By holding your money in USDT, you shield it from these local currency fluctuations. This stability enables you to move your funds between different investments with greater confidence, knowing its value remains steady.

Enhance Remittances

For many in Africa who receive money from family members abroad, Tether makes the remittance process more efficient. Traditional money transfer methods often come with high fees and delays. Using USDT for these transfers can reduce fees and speed up the process, ensuring that more of the money you send or receive, reaches its intended destination.

The Challenges of Trading in the African Market

Despite the many benefits Tether can bring to digital trading in Africa, several challenges need to be addressed:

Regulatory Barriers

- Unclear Rules

In many African countries, the rules about cryptocurrencies like USDT are unclear. This makes it hard for businesses and people to know what is allowed and what is not. Without clear rules, there is a risk of legal trouble, making people reluctant to buy USDT.

- Government Restrictions

Some African governments have restrictions or bans on cryptocurrencies. These restrictions can stop USDT from growing. Governments may worry about financial stability or illegal activities, which can lead to strict policies. Working with regulators to create balanced rules can help support USDT’s growth.

- Compliance Challenges

Businesses trading USDT need to follow financial rules and anti-money laundering laws. This often means they have to verify their customers and meet other requirements. This can be difficult and expensive, especially for smaller businesses.

Security Concerns

- Cybersecurity Risks

While Tether itself is secure, the platforms and wallets used for trading can be targeted by hackers. In Africa, where cybersecurity is still developing, the risk of hacking is higher. Using secure platforms like Jackocoins and following good security practices can help protect users.

- Fraud and Scams

The digital trading space can attract scams. People and businesses should avoid schemes that promise quick money or ask for upfront payments. Educating users about how to spot scams can help build trust in USDT.

- Privacy Issues

Protecting personal and financial information is crucial. Users need to know their data is safe when using USDT. Good data protection practices and following privacy laws can help build confidence in digital trading.

How to Get Started with USDT

You can start by choosing a reliable crypto exchange, and Jackocoins is an excellent option. It’s known for its user-friendly interface and strong security measures, ensuring a smooth and safe experience for buying and managing your cryptocurrencies.

Once you’ve created your Jackocoins account, you can deposit USDT by copying the provided deposit address. The process is quick and efficient, with Jackocoins offering competitive rates and low fees to make acquiring USDT hassle-free.

After you’ve acquired USDT, managing and storing it securely is crucial. Jackocoins offers secure wallets to protect your USDT, allowing you to track your balance and manage transactions effortlessly. With Jackocoins, you can confidently handle your USDT with peace of mind.

Future Prospects for USDT in Africa

The future of USDT (Tether) in Africa looks promising as the continent advances in digital finance and cryptocurrency adoption. Emerging markets in Africa present significant opportunities for USDT due to their increasing interest in digital currencies and the need for financial stability.

The untapped potential for USDT in Africa is substantial. As more people gain access to smartphones and the internet, the use of digital currencies like USDT is likely to expand. This growth could enhance financial inclusion by providing a stable currency option for those who lack access to traditional banking services. Additionally, the rise of e-commerce and online transactions in Africa creates fertile grounds for USDT adoption, as it offers a reliable and efficient means of conducting transactions.

Visits: 16