Bitcoin crashes below $60,000

Crypto prices are in the red to kick off the week, with Bitcoin falling below $61,000 as of 12pm yesterday. Ether dropped more than five and a half % to under $3,300, and Solana fell 4 % to $126.

Bitcoin has risen 40% year to date and 100% over the past year. This level of volatility is quite typical, as historical bull markets often experience multiple drawdowns of 30% or more. Bitcoin today has declined by approximately 15%, which falls within the expected range. When an asset appreciates significantly, it’s common for investors to take profits, contributing to market fluctuations. This year started with a significant rally, prompting some profit-taking. Additionally, many traders are engaging in basis trades, going long in the spot market while shorting futures, which helps dampen volatility and leads to some selling. As the summer approaches, a common strategy in public markets—”invest till May and then go away”—also influences behavior. Consequently, while there are strong moves early in the year, the fourth quarter remains a significant period for cryptocurrency markets.

Crypto Today: Mt Gox set to refund stolen digital assets to Users

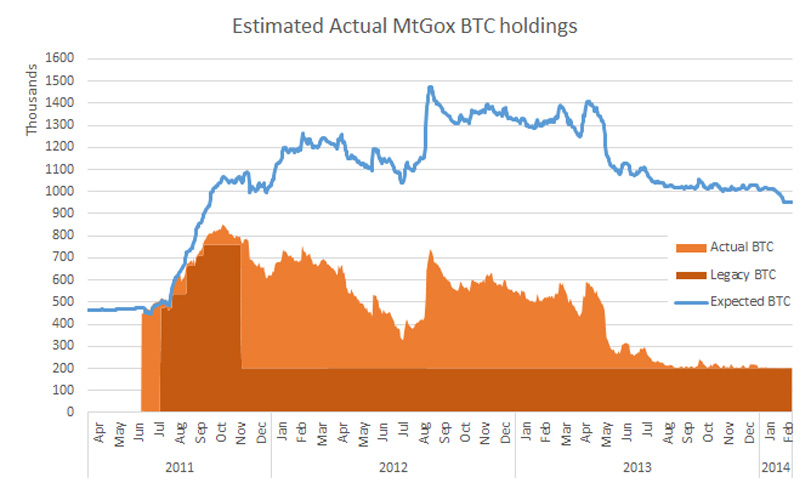

Finally, after years of postponed deadlines, Mount Gox said it plans to start distributing assets stolen from clients in a hack next month. The defunct Bitcoin exchange announced in this statement today that the repayments will be made in Bitcoin and Bitcoin cash.

The spokesperson said that the repayments will begin at the beginning of July 2024, noting that time has been allotted to ensure safe and reliable repayments to creditors, including technical remedies for safe payments, compliance with financial regulations in each country, and discussion of repayment arrangements with the crypto exchanges. Mount Gox, once the world’s largest Bitcoin trading exchange, went bankrupt back in 2014 after a massive hack, leading to billions of dollars in stolen Bitcoin. Creditors of the Japan-based exchange are still waiting to get their worth of Bitcoin repaid. The repayment deadline is now October 31st, 2024.

The U.S. SEC drops charges against the Ethereum network

After Ethereum’s Consensys announced that the SEC was dropping its investigation into the firm and the Ethereum Network, Ken Arad, CEO of Solidist Labs, discussed with CNBC what that decision from the agency means for the Ethereum Network.

According to him, Consensys shared on a blog post that they received a letter from the SEC letting them know that an investigation against their use of Ethereum has been dropped. Note that there is little official information out there beyond the blog post.

Why was it dropped? Considering the SEC is a securities regulator, it’s pretty clear that the investigation had to do with whether Ethereum is a security and, therefore, whether dealing with it without being a properly regulated security dealer would be an offense. Regardless, this is great news for the Ethereum network.

Although the SEC did emphasize, based on various reports in its letters, that it does not exclude the possibility of investigations or actions in the future, we can say that it’s less likely that Ethereum would be deemed a security, which will bring a lot of optimism. Eventually, prices will increase, leaving the industry feeling confident that Ethereum can continue growing as a technology without the risk of these investigations.

Follow Jackocoins blog and social handles for more news and crypto updates

Visits: 8864