The crypto industry is ever-evolving, with rapid new developments, trends, and innovations. For enthusiasts and investors alike, staying informed about the latest news is crucial.

This report explores the major trends in the cryptocurrency market for 2024, provides insights into the performance of key cryptocurrencies like Bitcoin, Ethereum, and USDT, and highlights how Jackocoins can help you stay ahead in this dynamic landscape.

Major Trends in the Cryptocurrency Market for 2024

The cryptocurrency market in 2024 features several key trends:

Bitcoin ETFs Approval

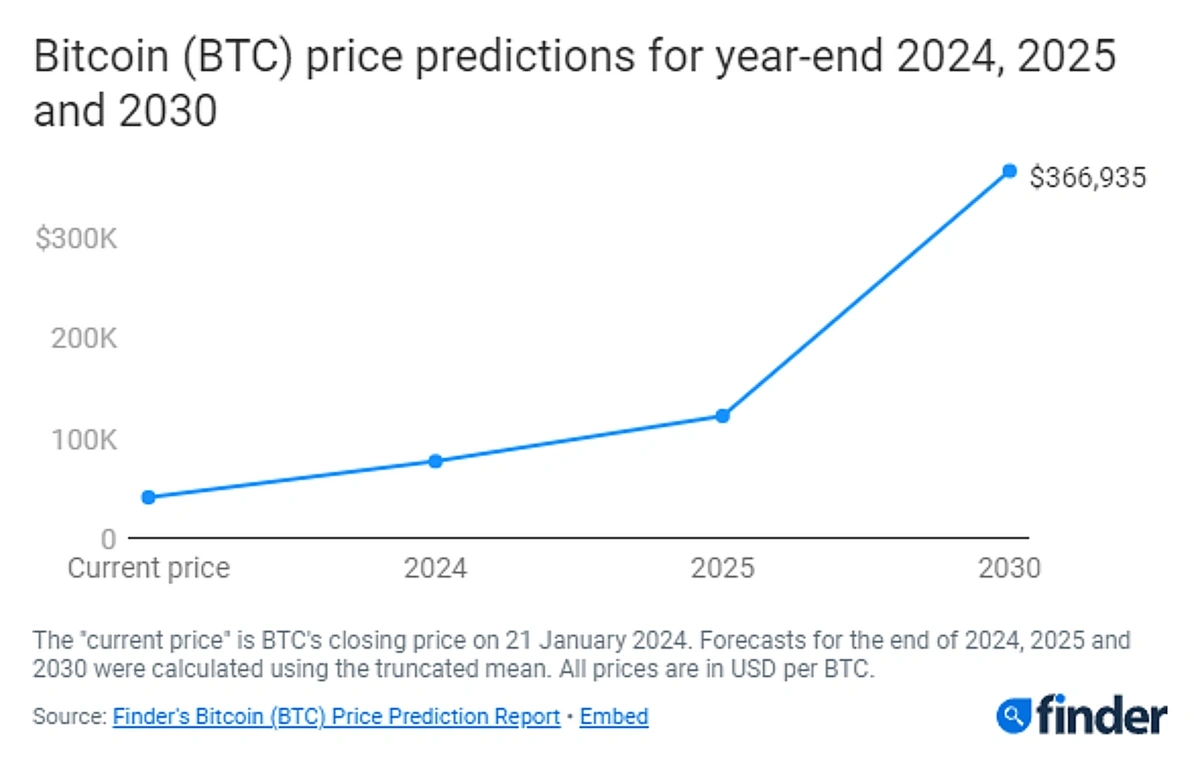

As we moved into 2024, Bitcoin’s value saw a remarkable increase of 150%. Many analysts believe that this bullish trend could continue well into 2025. Starting in 2024 at around $44,000, Bitcoin’s price climbed to nearly $70,000 by late May. According to a survey of cryptocurrency experts, Bitcoin targets $77,000 by the end of 2024 and could potentially hit $123,000 by the end of 2025. The Bitcoin ETF approval is one of two main factors driving the bullish market.

It could be recalled that brokerages began working on Bitcoin ETFs as early as 2013, but it wasn’t until January 2024 that the SEC approved the first spot ETF. These funds involve financial firms purchasing cryptocurrency and offering shares to investors. The investors do not directly hold Bitcoin, but the ETF’s value reflects in Bitcoin’s market price.

The approval of these ETFs boosts demand for crypto, as they allow investors to hold Bitcoin as a low-cost investment without needing to use a crypto exchange. For retail investors and wealth management advisors, this development is mouthwatering.

BlackRock and Fidelity have become leading players in the Bitcoin ETF market, with BlackRock managing $15 billion in Bitcoin assets and Fidelity managing $9 billion.

Bitcoin Halving

Another factor fueling interest in cryptocurrency is the Bitcoin halving event. This occurs roughly every four years, with the latest in April 2024. During a halving event, the reward for mining Bitcoin is cut in half, reducing the rate at which new Bitcoin pops up.

Analysts suggest that this reduction in supply could lead to increased demand. Data shows that the halving event directly impacts Bitcoin demand, although, these gains were not immediate. In a recent survey, nearly half of the crypto experts predicted that the price gains following the April halving event would peak around the six-month mark, similar to previous patterns.

AI and Crypto

Artificial intelligence (AI) also plays a supporting role. AI tokens are a type of cryptocurrency linked to AI-related projects. For instance, you can use them to pay for services or access data on the platform, while the platform rewards you with these tokens.

Fetch.ai is a prominent AI token platform. The platform garnered significant attention in late March when it announced a merger of its AI token with those from SingularityNET and Ocean Protocol. The alliance between these three companies aims to develop a decentralized approach to AI, challenging the dominance of AI protocols and platforms controlled by large tech corporations.

Regulation of Crypto Exchanges

The collapse of FTX and other cryptocurrency firms intensifies the focus on industry regulation. At the time, regulatory measures were sparse, but now government bodies are quickly stepping up enforcement efforts.

The Nigerian SEC advocates for increased regulation, asserting that the crypto market is “rife with fraud and manipulation.” The SEC treats cryptocurrencies as securities, similar to stocks. This classification requires crypto firms to register with the SEC and adhere to its disclosure regulations.

However, this guidance remains one of the few concrete regulations, with virtually no other government entities establishing specific laws or rules for crypto. Many crypto enthusiasts argue that existing regulations are unclear. Although other nations have codified regulations, the United States stands out for its active enforcement against major crypto companies.

Impact on Climate

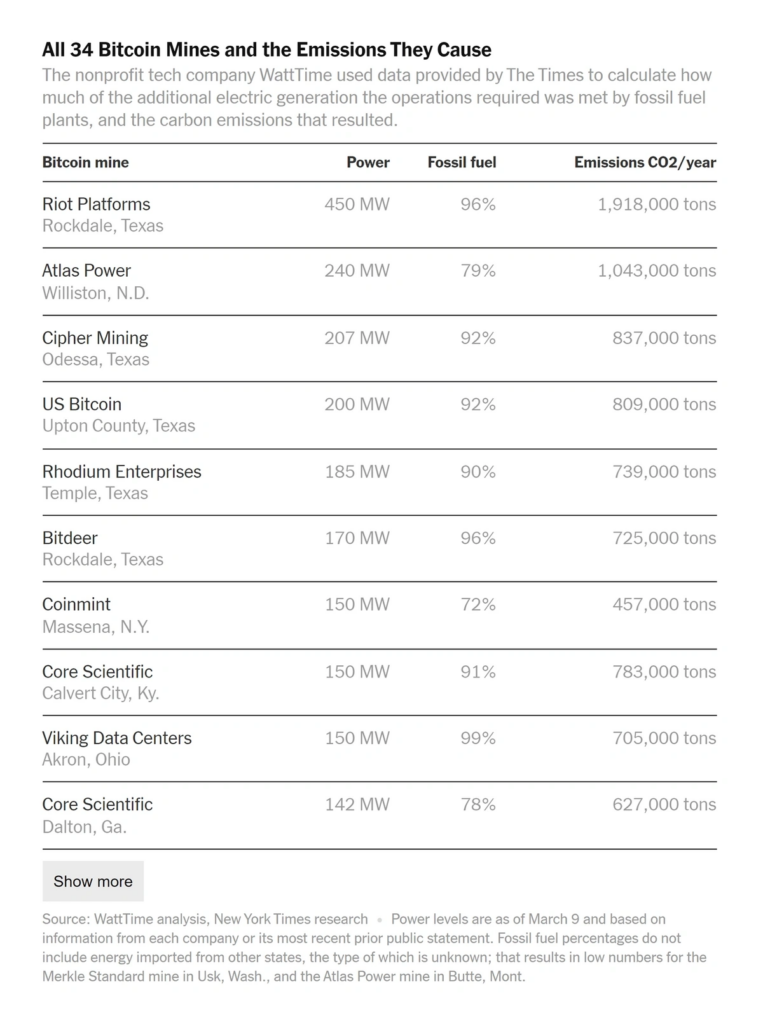

The environmental challenges stem from a step in the cryptocurrency mining process known as proof of work, which requires miners to solve complex mathematical problems using high computing power before they can add new blocks to the blockchain. No doubt this intensive computing demands a vast amount of energy and water.

The Cambridge Bitcoin Electricity Consumption Index reports that cryptocurrency production consumes about 1174 TWh of electricity annually more than the entire yearly electricity consumption of the Netherlands. Technically, a single Bitcoin transaction uses as much energy as an average U.S. household does in nearly 26 days. Meanwhile, United Nations scientists found that 67% of the energy used in crypto mining emits from fossil fuels.

Crypto mining also requires substantial water resources. Water is used not only for generating electricity but also for cooling the computer systems and maintaining the appropriate humidity levels for the machines. One study estimated that Bitcoin’s annual water consumption could reach as high as 2,237 gigaliters (GL).

In response to climate concerns, Ethereum launched The Merge in 2022, a software upgrade that reduced miners’ energy consumption and replaced the proof-of-work system with proof of stake, a verification method based on cryptocurrency holdings. Bitcoin, however, is unlikely to adopt a proof-of-stake model.

Real-World Assets Tokenization

Asset tokenization is a growing trend leveraging the blockchain technology that underpins cryptocurrencies. When you tokenize a real-world asset (RWA), a digital representation of that asset is created on the blockchain. Tokens can represent a variety of assets, including real estate, art, bonds, intellectual property, and more.

Tokenization offers numerous advantages, such as enabling the automation of specific actions related to the asset, providing traceability, facilitating fractional ownership, and increasing liquidity. These benefits are attracting the attention of financial institutions.

In 2024, BlackRock introduced its first tokenized asset fund, BUIDL, which operates on the Ethereum blockchain. Securitize, also partnered with BlackRock to launch the fund. Analysts suggest that by 2030, up to $16 trillion worth of real-world assets could be tokenized.

Central Bank Digital Currency (CBDC)

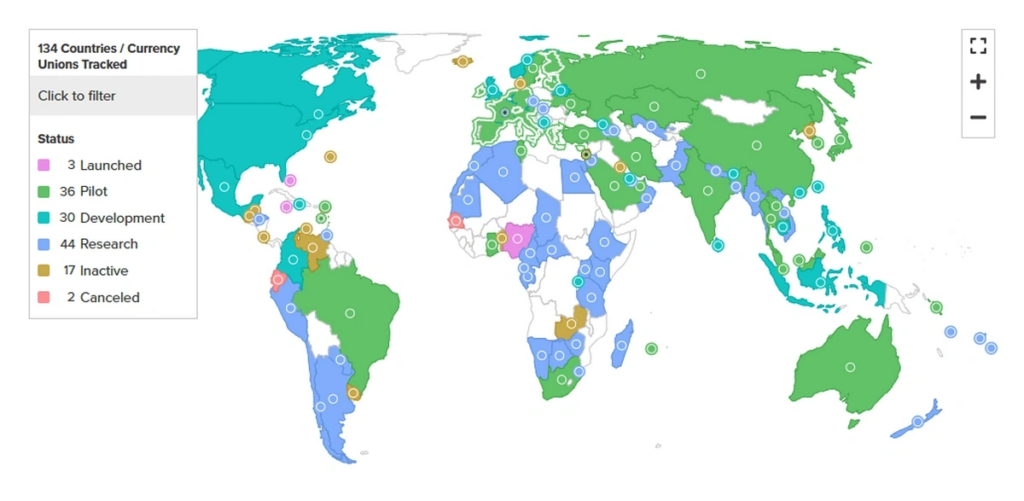

Banking systems globally are actively developing their Central Bank Digital Currencies (CBDCs). These digital currencies would be centralized and managed by the government.

CBDC aims to provide the advantages of cryptocurrencies without their associated risks. Currently, about 132 countries are ready to launch, representing 98% of the world’s GDP. Meanwhile, CBDCs are fully functional in Jamaica, Nigeria, and the Bahamas.

China is conducting the largest CBDC trial globally. The digital yuan, or e-CNY, has passed its production stage in 260 million wallets across 25 cities.

The Bank of International Settlements predicts that by 2030, 15 retail CBDCs (designed for consumer and business use) and 9 wholesale CBDCs (intended for banks) will be operational. To facilitate the integration of various CBDCs, the bank messaging network SWIFT plans to launch a network of CBDC platforms within the next year or two.

How to Stay Informed About the Latest Crypto News

Staying informed about the latest developments in the crypto world is essential for making informed investment decisions. Here are some tips:

- Follow Reputable News Sources: Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide up-to-date news and analysis.

- Join Crypto Communities: Engage with communities on Reddit, Twitter, and Discord to get real-time insights and discussions.

- Use Jackocoins: We offer diverse tools to help you stay ahead. Our services are designed to meet the needs of crypto enthusiasts and investors like you.

By signing up with Jackocoins, you can:

- Access Real-Time Market Data: Stay updated with the latest price movements, trading volumes, and market trends.

- Receive Expert Analysis: Benefit from in-depth analysis and insights from industry experts to make informed decisions.

- Secure a Trading Platform: Enjoy a secure and user-friendly platform for trading and managing your crypto assets.

- Educational Resources: Learn about cryptocurrencies, blockchain technology, and trading strategies through comprehensive guides and tutorials.

Ensuring Security and Reliability

Security is a top priority at Jackocoins. The platform employs advanced security measures, including encryption, multi-factor authentication, and hot storage, to protect your assets. Adherence to regulatory compliance is also assured, providing you a safe and trustworthy environment for trading and investing.

Visits: 8931