The world of finance is undergoing a significant transformation, and blockchain technology is at the forefront of this change. Security Tokens (STOs) represent a new era in investment, combining traditional securities with the benefits of blockchain. This article explores the world of STOs, their definition, benefits, potential to revolutionize the financial landscape, and how Jackocoins facilitates this innovative financial instrument.

What are Security Tokens?

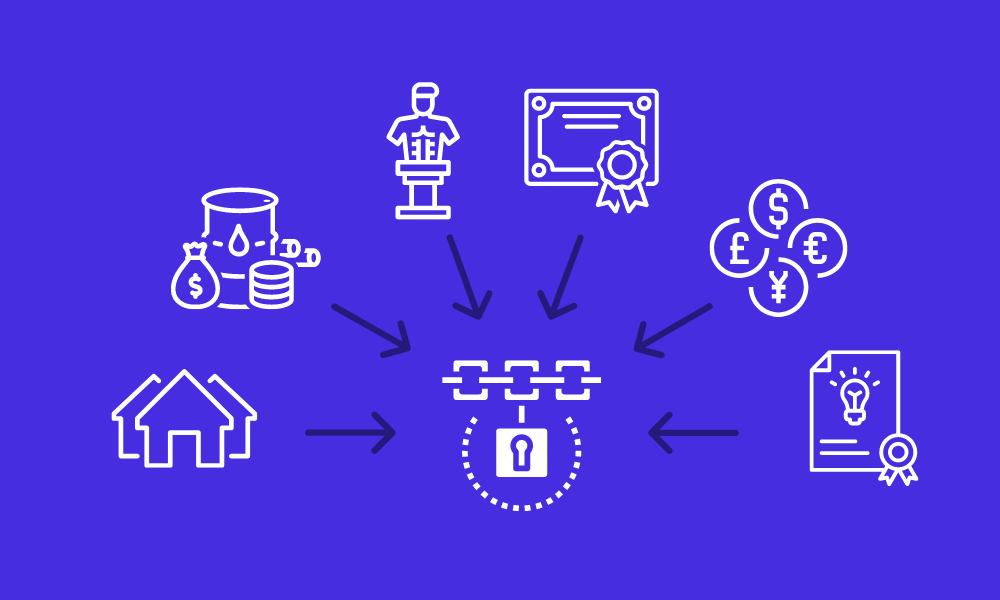

Security represents a slice of ownership or rights to an asset or company, while a token on a blockchain is a unique alphanumeric sequence generated through a hashing algorithm. Tokenization combines these concepts by transferring ownership of an asset to a blockchain and assigning it a token. This creates a security token, a digital representation of ownership or rights to an asset stored on a blockchain.

As an investment asset, security tokens represent ownership or rights, transferring value from an underlying asset to the token holder. In essence, security tokens are digital versions of traditional investments like stocks, bonds, or securitized assets. Tokenization is crucial to understanding security tokens, as it enables the creation of digital representations of various assets.

Tokenization can apply to anything, even a car’s ownership and registration. You can encrypt your vehicle identification number (VIN), owner’s information, and registration details and store it on a blockchain. This token can be bought and sold, transferring car ownership. Similarly, security tokens can represent ownership in companies, real estate, or other assets, offering a digital and secure way to invest and manage ownership.

Benefits of STOs

- Enhanced Liquidity

STOs bring a new level of liquidity to traditionally illiquid assets like real estate or private equity. With security tokens, you can trade these assets on secondary markets, giving investors more flexibility and access to their investments. This means you can buy or sell fractions of high-value assets, making it easier to enter or exit positions without the usual long waits or high transaction costs associated with traditional securities.

- Fractional Ownership

Blockchain technology allows you to own a piece of high-value assets by purchasing fractions, making investments more affordable and accessible. This fractional ownership democratizes investment opportunities, letting more people participate in markets previously reserved for wealthy individuals or large institutions.

- Transparency and Security

Blockchain’s immutable ledger ensures transparency in transactions, reducing fraud and increasing investor confidence. Smart contracts automate compliance with regulatory requirements, enhancing security.

- Compliance

Security tokens play by the rules! They comply with regulatory requirements, which means they protect investors’ rights and reduce the risk of fraud. STOs ensure that all transactions are above board and transparent, so you can invest with confidence. This compliance also means that security tokens can be traded on regulated exchanges, further solidifying their legitimacy and potential for growth. It’s a win-win for investors and regulators alike!

How are Security Tokens Different From Cryptocurrencies?

Security tokens and cryptocurrencies share similarities, but their purpose and use cases set them apart. Both work with blockchain technology, but their intentions and applications differ. Cryptocurrencies, like Bitcoin, are designed as digital currencies or payment methods, aiming to decentralize money and facilitate transactions.

However, some cryptocurrencies have taken on a new role as investment instruments, similar to security tokens. Bitcoin, for example, was not designed as an investment asset, but its listing on cryptocurrency exchanges led to it being traded and held for its increasing value, effectively becoming a security token.

Ethereum’s native token, ether, is another example. Initially designed to pay transaction fees within the Ethereum network, making it a cryptocurrency, it’s now traded on exchanges and held for its increasing value, leading investors to treat it as a security token. This blurs the lines between the two, highlighting the importance of understanding their distinct purposes and uses.

Is Ethereum a Security Token?

Ethereum’s native token, ether (ETH), is a cryptocurrency with a specific use case. It’s designed to facilitate transactions within the Ethereum Virtual Machine, serving as a payment method for transaction fees. Unlike security tokens, ether isn’t intended for investment or ownership representation. Instead, it powers the Ethereum network, enabling users to execute smart contracts and decentralized applications.

In addition to its primary function, ether holders can participate in the network’s validation process by “staking” their ETH. This involves locking up a certain amount of ether to become a network validator, contributing to the security and maintenance of the Ethereum blockchain. In return, validators are rewarded with additional ether, incentivizing participation and supporting the network’s growth.

By understanding ether’s purpose and use cases, it’s clear that it operates differently from security tokens, which represent ownership or investment in a project or asset. Ether’s unique role within the Ethereum ecosystem sets it apart, making it a fundamental component of the decentralized web.

Regulatory Considerations

Security Tokens (STOs) are subject to securities regulations, which differ by region. These regulations are designed to safeguard investor interests and maintain market integrity. In Nigeria as well as other countries like the United States, for example, STOs must adhere to the Securities and Exchange Commission (SEC) guidelines, which include:

- Registering with the SEC or

- Qualifying for exemptions from registration

These regulations ensure that STOs operate transparently and fairly, providing investors with the necessary protections and information to make informed decisions. Compliance with regulatory requirements is crucial for STOs to have legitimacy and credibility in the market.

The Future of Security Tokens (STOs)

Security Tokens are poised to restructure the financial industry, and their potential is vast. As the market continues to evolve, STOs will play an important role in shaping the future of investment. With their transparency, security, and compliance, Security Tokens will democratize access to investment opportunities, unlocking new possibilities for investors and issuers alike. As the world becomes increasingly digital, STOs will be at the forefront of this transformation, creating a new era of investment and growth. By embracing this technology, you can build a more inclusive, efficient, and secure financial system for all.

How Jackocoins Facilitates STOs

Jackocoins, a leading cryptocurrency exchange in Nigeria, offers a platform that supports the storage and sale of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). They provide high liquidity, competitive rates, and secure storage, positioning themselves as a reliable partner for STO transactions.

Services Offered by Jackocoins

- Secure Storage

Jackocoins ensures the security of digital assets through robust storage solutions, protecting them from cyber threats.

- High Liquidity and Competitive Rates

Jackocoins offers high liquidity and competitive rates, making it easier for investors to buy and sell tokens.

- 24/7 Customer Support

With around-the-clock support via WhatsApp, email and online social channels, Jackocoins dedicates its service to assisting users with their needs promptly.

Conclusion

Security tokens are the digital counterparts of traditional assets on stock markets. They aim to raise capital, generate returns, or distribute dividends. Like traditional stocks, security tokens must be register with regulatory bodies, such as the Securities and Exchange Commission (SEC), to ensure compliance and investor protection. As the financial landscape continues to evolve, platforms like Jackocoins are crucial in facilitating these innovative financial instruments. To start leveraging the benefits of STOs, sign up with Jackocoins and explore their comprehensive range of services designed to meet your investment needs.

Visits: 9777