As the second-largest cryptocurrency by market capitalization, Ethereum stands as one of the pivotal players in the cryptocurrency market. Today, we will discuss Ethereum price analysis and explore recent trends to enable you to make informed predictions for the future.

Ethereum’s Origin and Objective

It all began with a young programmer named Vitalik Buterin, who, at the age of 19, envisioned a platform that went beyond Bitcoin’s financial applications. Born in Russia and raised in Canada, Vitalik’s journey started early, when he co-founded Bitcoin Magazine in 2011. In 2013, driven by his vision of a decentralized world computer, Vitalik published a white paper outlining Ethereum’s potential. Unlike Bitcoin, Ethereum was designed to be more than a digital currency; it would support smart contracts and decentralized applications (dApps), fundamentally changing how we interact with the internet. After a successful crowdfunding campaign in 2014, Ethereum was officially launched on July 30, 2015, quickly gaining traction and reshaping blockchain technology.

Historical Price Trends

Since its inception, Ethereum has experienced significant price volatility. Initially, ETH was priced at around $1 for several months after its launch. In early 2016, the value began to climb rapidly as interest in blockchain technology grew and Ethereum’s smart contracts promised to enable new decentralized applications (dApps). By June 2016, ETH had climbed above $18.

In the second half of 2016, ETH settled around $10-15 for several months, eventually dropping to about $8 by the end of the year. It began its bullish momentum again in early 2017, spurred by a wave of initial coin offerings (ICOs) launched on the Ethereum platform. During the first significant cryptocurrency rally, ETH exceeded $300 in mid-2017, reaching a peak of approximately $1,400 by January 2018.

The cryptocurrency market turned bearish in early 2018, and ETH was affected by this downturn. By September 2018, the price had fallen to around $200 and remained in that vicinity for much of the year. ETH rebounded in early 2019, climbing back above $300 by mid-year.

ETH experienced another surge in the latter half of 2020, driven by the expansion of the decentralized finance (DeFi) sector and the rising popularity of non-fungible tokens (NFTs) on its blockchain. By the end of 2020, ETH was priced at around $700, and the rally continued into early 2021, reaching a new high of $4,362 in May.

However, the market faced a significant downturn later in May due to regulatory concerns, including China’s crackdown on crypto mining and Tesla CEO Elon Musk’s announcement that the company would stop accepting Bitcoin payments due to environmental concerns. This led to a sharp decline in the crypto market, and by July, ETH had dropped below $2,000.

Ethereum Price Analysis

Ethereum price analysis involves examining various factors that influence its market value. These factors include market demand, technological developments, regulatory news, and macroeconomic trends. These elements enable investors to make informed decisions.

- Market Demand and Supply

Like any other asset, Ethereum’s price is driven by the balance of demand and supply. When demand for Ethereum surges and supply remains limited, prices naturally rise. Conversely, if there’s an oversupply and demand dwindles, prices can drop. Keeping an eye on market trends can help predict these shifts.

- Technological Advancements

The continuous improvement of the Ethereum network plays a crucial role in its valuation. For instance, upgrades like Ethereum 2.0, aimed at enhancing scalability and security, can boost investor confidence. Staying updated with these technological changes can provide insights into potential price movements.

- Regulatory Environment

Government regulations and legal news significantly impact Ethereum prices. Positive regulatory news can lead to price hikes, while negative developments might cause downturns. Monitoring regulatory updates helps in anticipating market reactions.

- Macroeconomic Trends

Broader economic factors like interest rates, inflation, and geopolitical events also affect Ethereum’s market value. For example, financial instability can drive more investors to seek refuge in cryptocurrencies, influencing prices. Awareness of these larger economic trends can aid in making informed investment choices.

Ethereum Price Today

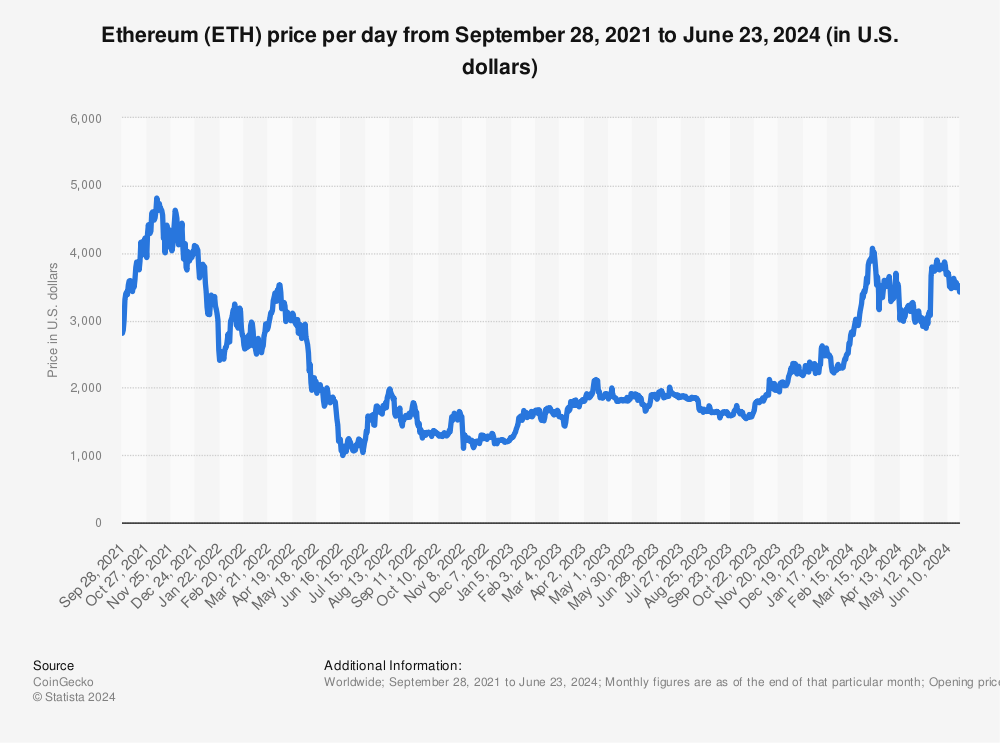

In 2023, Ethereum experienced several upgrades, most notably the Shanghai upgrade. As institutional adoption of Ethereum increased, its role in the digital economy strengthened. Optimism around potential Federal Reserve interest rate cuts also helped boost both equities and cryptocurrencies. In April 2023, ETH reached a peak of $2,140 but later declined to $1,520 by October.

Crypto prices began rising again in early 2024 amidst rumors of Bitcoin ETF approvals, which were true. Concurrently, expectations of a ‘soft landing’ for the US economy and decreasing inflation spurred risk assets like Ethereum. ETH surged nearly 95%, climbing from a low of $2,101 in January to a high of $4,090 in March, marking its highest point since 2021.

Although prices pulled back to $2,815 by late April, Ethereum rebounded sharply, reaching around $3,850 by early June. The bullish sentiment has been largely driven by the anticipation of an Ethereum exchange-traded fund (ETF). In May, the US Securities and Exchange Commission (SEC) approved revised 19b-4 filings for Ethereum ETFs, signaling one of the final steps before full approval. We expect the SEC to approve Ethereum ETFs later this year.

Ethereum’s Price for the Future

Ethereum’s future prospects follow several factors, providing both opportunities and challenges. Some analysts believe that technological progress, regulatory changes, and market dynamics will play a role in determining Ethereum’s performance in the future.

By 2025, Ethereum expects to undergo some technological advancements, particularly by adopting Layer 2 solutions like optimism and arbitrum. These technologies aim to improve scalability and lower transaction costs, making Ethereum more user-friendly for dApps and DeFi projects. Additionally, implementing sharding technology will boost network efficiency and throughput, reinforcing Ethereum’s status as the best platform for smart contracts and dApps.

Analysts also predict that broader economic conditions, including monetary policy, will impact Ethereum’s performance in 2025. As central banks, including the Federal Reserve, make significant strides in lowering interest rates, Ethereum may become more appealing to investors seeking higher returns in a low-interest-rate environment.

Lastly, the expanding use of Ethereum for various applications, such as stablecoins and Web3 projects, underscores its increasing utility and demand. The growth in active addresses and wallet holders reflects the network’s broadening user base and deeper integration into mainstream financial systems.

Jackocoins for Optimal Investment

Jackocoins helps investors like you navigate crypto with ease. Here’s how Jackocoins can enhance your Ethereum investment strategy:

- Analytics Tools: Jackocoins offers a suite of analytical tools to help you understand market trends and make informed decisions. These tools include real-time price tracking, historical data analysis, and predictive modeling.

- Expert Insights and Reports: You can stay updated with the latest market insights and expert opinions through Jackocoins’ regularly published reports. These reports provide valuable information on market movements, regulatory updates, and technological advancements.

- User-Friendly Interface: Jackocoins offers an intuitive platform that makes it easy for both beginners and experienced traders to manage their investments. The user-friendly interface ensures a seamless experience, from tracking prices to executing trades.

- Educational Resources: Whether you’re new to crypto investing or looking to enhance your knowledge, Jackocoins offers a range of educational resources. These include tutorials, webinars, and articles to help you stay informed.

Conclusion

Ethereum price analysis remains vital for any investor looking to succeed in cryptocurrencies. To succeed, you must understand the factors influencing Ethereum’s price and learn the latest trends. Jackocoins offers the resources and tools you need to navigate this complex landscape confidently. Sign up today and start making the most of your Ethereum investments!

Visits: 9849