Can we all agree that 2024 has set the stage for monumental shifts in the crypto landscape?

We have Bitcoin ETFs, drawing over $30 billion in investor capital and bridging the gap between individual investors and institutional giants.

Now, looking ahead to crypto 2025, the crypto sphere stands at the cusp of even greater transformation, largely influenced by the outcomes of the 2024 presidential election, where cryptocurrency has emerged as a pivotal campaign issue for the first time in history!

Here are three key developments anticipated on the horizon, ranked by their likelihood of occurrence.

Expansion of Crypto ETF Offerings

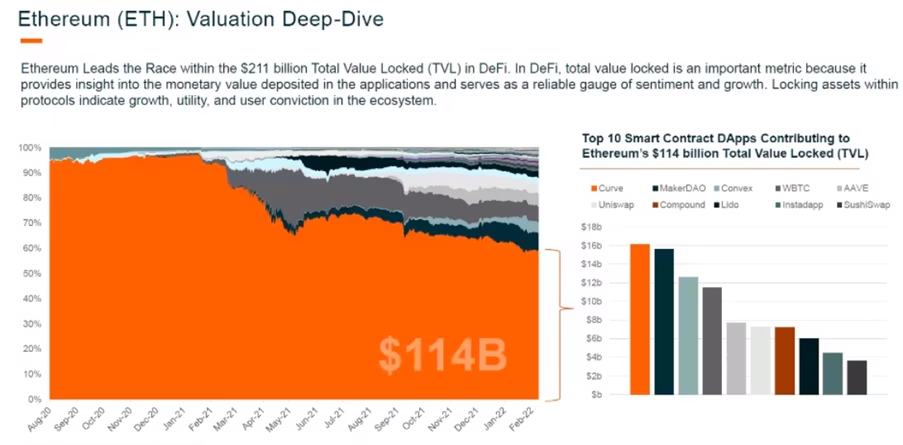

Following the resounding success of Bitcoin ETFs, the stage is set for a proliferation of similar products in 2025. Ethereum (ETH) ETFs have already debuted, signaling broader acceptance and paving the way for other major cryptocurrencies like Solana and XRP to follow suit. These ETFs not only simplify investment but also enhance market liquidity, appealing to a wide spectrum of investors, from retail traders to institutional players.

Regulatory Overhaul in the United States

The regulatory landscape for crypto in the United States feeds on ambiguity and outdated frameworks. However, 2025 could usher in a new era of clarity and fairness, driven by bipartisan calls for comprehensive crypto legislation. Currently overseen primarily by the SEC under decades-old statutes, the push is on to establish a modern regulatory framework. This shift aims to adapt regulatory oversight to complex modern digital assets by industry leaders such as Coinbase Global.

Bitcoin’s Strategic Role in National Policy

As geopolitical tensions rise, Bitcoin becomes a strategic asset with potential national security implications. Calls for bolstering the U.S. Bitcoin mining industry underscore a broader ambition to secure technological sovereignty amidst global competition, particularly from China and Russia. The concept of leveraging Bitcoin reserves to address national debt challenges has also gained traction. Legislative efforts also highlight its potential as a financial hedge and long-term economic strategy.

Investing Crypto in 2025

For investors eyeing crypto opportunities in 2025, positioning portfolios to capitalize on these potential changes is paramount. Bitcoin remains a focal point, given its dominant market position and heightened regulatory scrutiny. Meanwhile, developments in global crypto legislation, such as the EU’s MiCA regulation, provide insights into possible market impacts beyond U.S. borders.

Another way to secure your investment is to trade with a versatile, reliable, and secure platform, like Jackocoins. With over 35,000 users and more than $500,000 transactions made on the app, Jackocoins redefines crypto trading

Why not boost that investment with an app that offers you high coin rates, speedy fiat payments, and a robust crypto wallet that’s big enough to handle all your coins and strong enough to secure them?

You plant, we make it grow.

Simply sign up, get verified, and start trading!

The bottom line

Crypto 2025 holds immense promise and uncertainty for the crypto industry. From expanding ETF offerings to regulatory reforms and Bitcoin’s evolving strategic role, each development promises to reshape the financial landscape.

Stay informed and ahead of the crowd with Jackocoins blog.

Till next time!

Visits: 2698