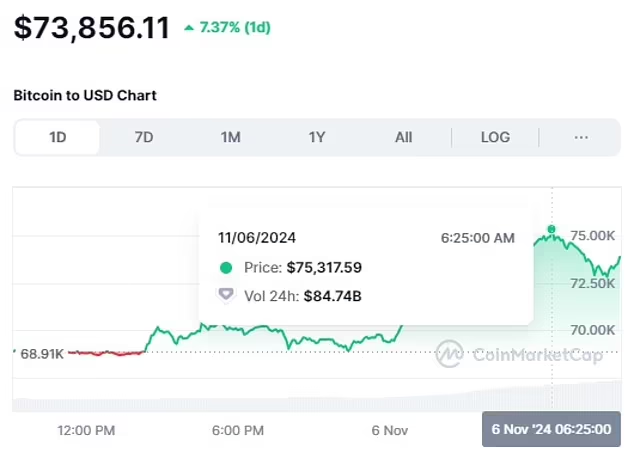

In an extraordinary turn of events, Bitcoin has once again smashed through its previous records, surging past $75,000 amid a whirlwind of market volatility and political change. The cryptocurrency soared over 8% within just 24 hours, reaching a new peak at $75,358, before settling around $74,461 during the early London session on Wednesday, November 6. This historic milestone has captivated the cryptocurrency community and signals broader interest and confidence in digital assets worldwide.

Is Trump’s victory a sign of a new Crypto Era?

Bitcoin’s surge above $75K has not happened in isolation; it coincides with a notable shift in U.S. politics. Former President Donald Trump recently claimed victory over Kamala Harris, becoming the 47th President of the United States. Historically, political events have had significant impacts on financial markets, and cryptocurrencies are no exception. As governments and central banks worldwide navigate policy shifts and economic challenges, Bitcoin continues to stand out as an appealing alternative, especially in times of uncertainty.

Following Bitcoin’s climb, the entire cryptocurrency market has swelled to a staggering $2.58 trillion, marking a 6% surge in total market capitalization. As Bitcoin breaks into uncharted territory, it’s bringing the rest of the crypto market along. This massive rally, however, has left an undeniable mark on leveraged traders, particularly those who bet against the bull run.

The Wreckage Left Behind: Over $531 Million Liquidated

The unprecedented rise has been both a blessing and a curse—especially for traders who took leveraged short positions against Bitcoin and other popular cryptocurrencies like Dogecoin. Within hours of Bitcoin’s ascent, over $531 million worth of leveraged positions were liquidated, a phenomenon in crypto known as being “rekt.” This term, popular in crypto circles, refers to traders who suffer extreme financial losses after betting against a price surge. A high-profile “whale” investor lost over $74 million attempting to short Bitcoin right as it reached new all-time highs.

Why you should never bet Against Bitcoin

Lookonchain, a leading on-chain data analysis firm, provided insights into this high-stakes drama. Their analysis revealed that a single whale—an investor with significant crypto holdings—suffered a jaw-dropping $74 million loss after betting that Bitcoin would fall. Unfortunately for this whale, the market had other plans, and Bitcoin’s meteoric rise quickly turned this gamble into a multi-million dollar loss.

Does Trump’s victory call for celebration or caution for investors?

As Bitcoin reaches new highs, the implications for retail and institutional investors are substantial.

For one, it reinforces it’s status as a long-term store of value, encouraging institutions to invest in their balance sheets. For traders, however, Bitcoin’s unpredictability is a stark reminder of the risks involved, especially in leveraged trading.

Bitcoin’s rise past $75K is a testament to the growing demand for decentralized, non-sovereign assets in an increasingly unpredictable world. With the political landscape shifting and economic uncertainties looming, Bitcoin’s role as a hedge against traditional markets only strengthens.

Stay tuned to Jackocoins blog for updates and don’t forget to sell your bitcoin at the highest rates on Jackocoins.

Visits: 35

“Outstanding post! The research quality and clarity blew me away. The way you’ve structured each point shows your deep understanding of the topic. I’ve learned so much from your expert insights.”