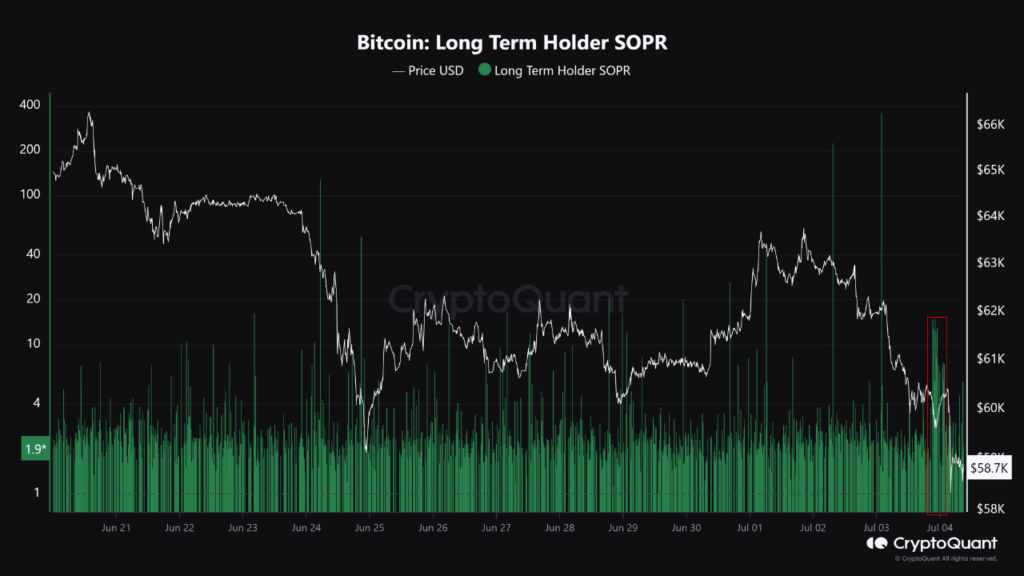

Early Thursday morning, I was surprised to see Bitcoin’s price dip below $58,000 for the first time in two months. This unexpected drop set off a domino effect, pulling down other major cryptocurrencies as well

.

Bitcoin’s Domino Effect

So, what triggered this sudden plunge?

The buzz is about the defunct Mt. Gox exchange and its plan to release a significant amount of Bitcoin to its creditors. If you remember, Mt. Gox was once a giant in the Bitcoin exchange world until it collapsed in 2014 after a massive security breach.

Bitcoin, which sat comfortably, trading above $60,000, took a hit of over 5% in the past 24 hours. It’s not alone in this downward trend—Ether, another major player in the crypto space, dropped more than 5.4% to fall below $3,200. And the ripple effect didn’t stop there. Binance’s BNB, Solana, and Dogecoin saw declines of 6.1%, 8.8%, and 7.2%, respectively.

The market’s jitters are primarily due to the upcoming distribution of approximately 140,000 Bitcoins (worth about $8 billion) to Mt. Gox’s creditors. The concern is that these creditors might sell off some of their newly reclaimed Bitcoins, potentially causing further declines in cryptocurrency prices. This payout will be happening in stages, meaning we might see ongoing volatility in the market.

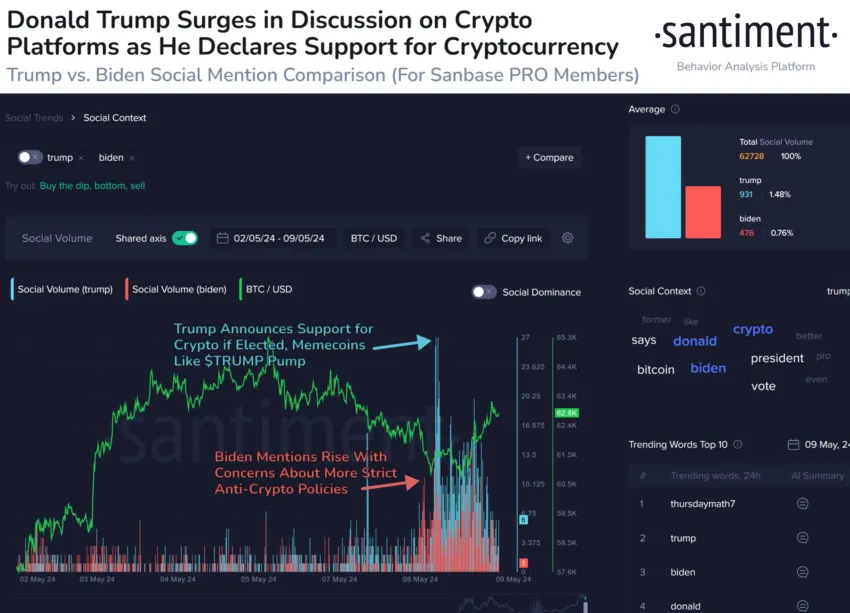

The “Trump” Effect

But there’s more to the story.

Analysts from Bloomberg also point to political uncertainties in the United States as a factor influencing the crypto market. With the presidential election on the horizon, there are growing concerns about President Joe Biden’s performance and whether a stronger Democratic candidate might step in to challenge former President Donald Trump, who has been quite vocal about his support for cryptocurrencies.

In the past month alone, Bitcoin’s value has dropped by a whopping 18.3%, a stark contrast to its peak of over $73,700 back in March, fueled by the launch of spot Bitcoin exchange-traded funds.

It’s definitely a turbulent time in the crypto world. If you’re invested, it’s essential to stay informed and keep an eye on both market trends and the broader geopolitical landscape.

Who knows what the next twist or turn might bring?

Till next time, my dearest readers!

Visits: 11494